As Bitcoin Legends Tumble, A Broader Look at the Sector

The world of Cryptocurrencies and Bitcoins is in a state of tumult over the past few months with serial exposes on fraud in this financial sector. In the first week of November 2023, a United States court convicted Sam Bankman-Fried, who founded one of the largest crypto exchanges, on charges of fraud and money laundering with a potential sentence of 115 years in prison. This was followed by the resignation of Binance CEO Changpeng Zhao on November 21, pleading guilty to breaking anti-money laundering laws of the United States. Changpeng Zhao has reportedly struck a $4.3 billion dollars deal with the Justice Department, as part of a large settlement between Binance and U.S. agencies.

Even as these developments are rocking the international financial sector as a whole, and the Bitcoins world in particular, awareness about these new age currencies as well as the methods of transactions using them are limited, especially among the lay population.

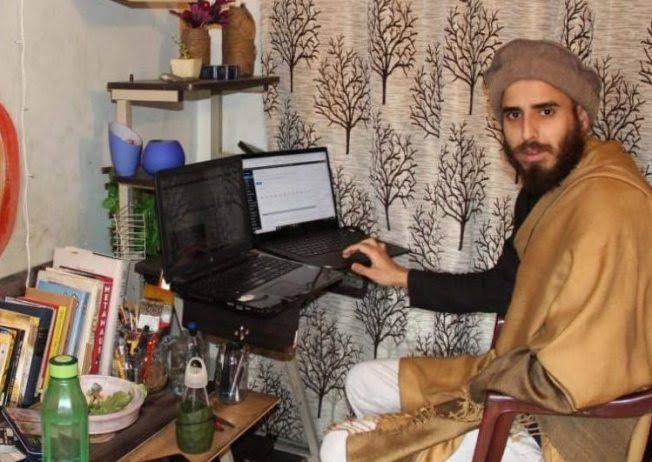

In this context, The AIDEM presents a three part series on the Bitcoin world by UK based technologist, author and technical architect Rajanarayanan Thottuvaikkatumana.

Each segment of the series can be read as stand-alone articles too as they address different aspects of the Bitcoins phenomenon. Following is Part 1 of the series. The remaining parts of the series would be published over the next two fortnights.

The Bitcoin Revolution, A Layman’s Perspective

All of us are very familiar with currencies such as Indian Rupee, US Dollar, Euro, UK Sterling Pound etc. These are fiat currencies. In other words, these are currencies issued and backed by governments. All these currencies have got a physical manifestation in paper form and coin form. The central banks of the currency issuing country mints and circulate them through various banks in the country. Fiat currencies can be exchanged by hand and via bank.

Centuries ago, the currency of a given country was used only within that country. Since the commencement of world trade and wars, some of the currencies got “more value and prominence” than other currencies. Individuals, merchants, and governments started holding a “reserve” of the currencies which has acceptability across multiple countries. Subsequently, serious foreign exchange money rules, backed by the laws within the country also evolved and changed frequently. In other words, the banks, financial institutions, and governments started holding hands with each other and started controlling the individuals, merchants and even countries.

Libertarians live everywhere at all times. Let us focus on financial libertarians here. They always wanted to deal with transactions in a way without coming under the radar of third parties outside the transaction scope. The other parties outside this scope can be individuals, merchants, police and governments. The barter system was one such arrangement. Its scope was very limited. Then came the use of precious materials and metals including but not limited to diamond, gold, and silver. Out of all these options, gold got prominence and got a global appeal. Based on the demand/supply equation, per gram value was assigned to gold and transactions started happening using gold as a medium of exchange. You need to understand what are the properties of gold that satisfies as a medium of exchange?

It stores value. Let the base value be the fiat currency of a given country. For example, one gram of gold is approximately valued at ₹6,000 as of today in India. It is a tender that is being accepted by many but whether it is a legal tender is a significant question and it is still under debate. It is easily verifiable. There are many mechanisms in which you can check the quality of the gold. It can be circulated easily by carrying it around. It can be stored without being noticed. It is NOT available in abundance as mining is the only way to get it. It prevents double-spending, meaning that for the goods and services availed, you need to physically exchange gold and once spent, you cannot spend it again. There are many more properties of gold (or any such precious metals) that makes it worthy of investment. Note that many fiat currencies of the world in circulation are based on a fixed quantity of gold that the concerned country holds in its treasury. This idea is popularly known as the gold standard.

We have seen that gold is being used as a “universal currency”. Using gold, you can take your assets from one country to the other country without being noticed by the financial system. This makes it a perfect choice for doing all the possible illegal activities, financial fraud, money laundering etc. But the biggest trouble of using gold is that it is a physical thing. The more value you need to carry, the more gold you need to carry. This becomes very cumbersome when you are dealing with high value transfers using gold across the globe.

Since Jan 3, 2009 the alternate “currency” or cryptocurrency named Bitcoin has taken the world by storm. The idea was circulated in the paper Bitcoin: A Peer-to-Peer Electronic Cash System [1] by its elusive author Satoshi Nakamoto. Satoshi’s revolutionary paper starts with a description of what Bitcoin is and it goes like this “A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution”. We have seen that the fiat currencies originate and get circulated through a network of financial institutions and by hand. But Bitcoin goes from hand to hand without an intermediary in between. But there is an ecosystem that maintains a Bitcoin ledger that captures all the Bitcoin transactions. In the traditional financial system, identities transact through a trusted third party to deliver value to the counterparty. In this whole series of transactions, the general public can’t see what is going on. There is no transparency here. In the case of Bitcoin transactions, the identities are hidden and the transactions are public.

Let us look at the whole Bitcoin ecosystem. There are many elements and terminologies here.

Entity: An entity can have multiple identities. Identities are identified by a combination of a public key and its corresponding private key. The public key is equivalent to an account number in your bank and the private key is the secret to transact Bitcoins associated with that identity

Wallet: A software that holds the public/private key pairs of a given identity. A Bitcoin Wallet has the capability to create identities as well.

Network: The Bitcoin network is a peer-to-peer network comprising a large pool of high performance computing power. The term peer-to-peer part is very crucial here in the sense that there is no “master” system controlling the network

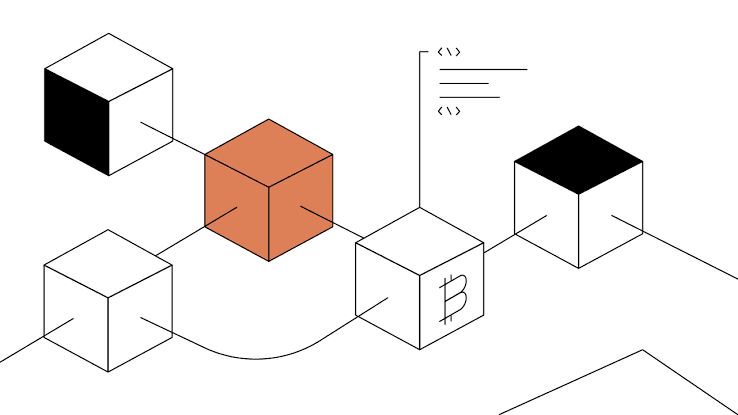

Miners: These are computing nodes in the Bitcoin network that collects transactions published to the Bitcoin network and organises them to ledgers known as Blockchain. In essence these mining nodes hold the ledger containing all the Bitcoin transactions.

Blockchains: This is the ledger that captures all the Bitcoin transactions. It literally means blocks of Bitcoin transactions that are organised in a chain in a chronological fashion. You can look up the blocks and see what is the balance you hold for a given identity’s public key or account number. If you know a public key, you can view the balance from popular block explorers. Each of the mining nodes in the Bitcoin network will have exactly the same copy of this huge ledger

Exchange: We have seen that there is no third party needed to be involved in the Bitcoin ecosystem to do transactions. Individuals can get a Bitcoin Wallet and start doing Bitcoin transactions. But it requires pretty good sophistication in terms of Bitcoin knowledge especially when dealing with the transactions and protecting identity. But for the layman, understanding the whole ecosystem and its inner workings is beyond their capability. To fill that gap, the Bitcoin Exchanges started coming up to help general public trade Bitcoin.

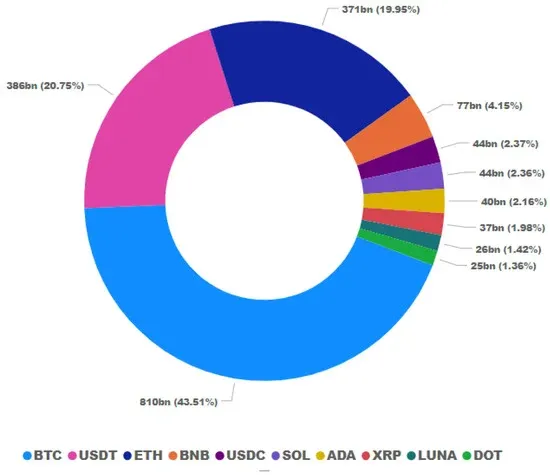

There are many other cryptocurrencies similar to Bitcoin in the market. These exchanges are popularly known as Cryptocurrency Exchanges as most of them trade multiple cryptocurrencies. This Forbes article [2] talks in detail about cryptocurrency exchanges and it starts like this “The size of the cryptocurrency market is now worth more than one trillion, witnessing a craze for digital currencies and decentralised finance. Every now and then hundreds and thousands of virtual currencies are cropping up. The curious segment of crypto investors thus need to know more about a proper platform which allows them to trade swiftly in various digital assets.”

An entity like you or me downloads a Bitcoin Wallet Software and creates identities. This is just like opening a bank account. Using the public key of the identity, you can receive Bitcoins. In the first place assume that someone (a third party) sends you a Bitcoin. The third party uses his/her Wallet to send Bitcoin to your public key. The Wallet publishes the transaction to the Bitcoin Network. The Miners (computing nodes) pick up this transaction and include them in the next block of the ledger aka Blockchain. Your Wallet software checks the balance of your account or public key in the Blockchain. Once the miners finish the update, you will have the balance updated in your Wallet against your identity. Now you own that Bitcoin. You can spend that by sending it to someone else. But for doing that, you should know your public/private key pair and the recipient’s public key. All these activities described here are not easy or intuitive for the uninitiated.

The cryptocurrency exchanges let users sign up to open an account and let you do all sorts of transactions such as buy and sell Bitcoin. In these exchanges, you can use fiat currencies to buy or sell Bitcoin. It is important to note that you need to reveal your identity when you are opening accounts in cryptocurrency exchanges as many of them are working in the financially regulated space. As an end user it is extremely important to evaluate the cryptocurrency exchange you are planning to use. There have been many debacles related to cryptocurrency exchanges and millions of dollars worth of assets have been syphoned by crypto criminals in the past.

The most important and recent high profile case was the FTX exchange collapse and more details can be read from the following article Why Did FTX Collapse? Here’s What to Know [3].

Now let us look at some of the properties of Bitcoin that makes it valuable and why there is still demand for it. Originally when we looked at some of the properties of gold, we could see that gold is a very good store of value acceptable globally. Let us see how Bitcoin is comparable

Value Store: Bitcoin is still in demand. People are ready to buy and sell. People buy Bitcoin using their fiat currencies. Similar to gold, the Bitcoin price fluctuates based on the demand supply dynamics of the economy.

It is a Tender: Bitcoin is a tender in many countries. In other words, you can use Bitcoin to buy goods and services. Many ecommerce websites accept Bitcoin as a payment method.

It is Verifiable: When you want to sell gold, there are ways to verify the quality of the gold. Similarly when you are transacting Bitcoin only if you know your public/private key pairs and the third party’s public key you can do the transaction. The miners who are including these transactions in the transaction blocks of the Bitcoin Blockchain, can easily verify the validity of the transaction and then only the legitimate ones get into the ledger.

Easy Circulation: Very similar to the way we do online banking transactions, using the Bitcoin Wallets, you can transact Bitcoin very easily. Making payments for the goods and services, transferring Bitcoins to other parties etc are very easy. There is a strong ecosystem of the network and miners who enable this.

Safe Storage: As all of you are aware, the Bitcoin Blockchain containing blocks of Bitcoin transactions or the ledger is public. In other words, all the Bitcoin transactions that have happened till date since the genesis block was created are publicly available for scrutiny and analysis. As an entity if you have multiple identities (public/private key combinations), as long as you keep your private keys, your Bitcoins will be safe. Nobody can take it from you.

Scarce Resource: As per the economic theories, if something is available in abundance, there is not going to be value for it. If gold is available in abundance, it will lose its current value. Bitcoin is no different. Bitcoin is a scarce resource. At the most, there can only be 21 (twenty one) million Bitcoins in circulation. Out of this, approximately 93% is in circulation now and the rest is to be mined.

Double Spending Prevention: A Bitcoin cannot be spent twice. Once I spent a Bitcoin which is there in my Bitcoin Wallet, I cannot spend it again. There are very strict protocols governing the spending and transacting of Bitcoin.

The Bitcoin White Paper [1] by Satoshi Nakamoto gives a whole lot of Mathematics, Probability Theories and Computer Science aspects of maintaining security, logic of mining Bitcoins, and how the number of Bitcoins in the market is controlled etc in great detail. Detailed coverage of those details is not in the scope of this article but interested readers can take a look.

References:

[2] Forbes Article

Read PART TWO, here. To receive updates on detailed analysis and in-depth interviews from The AIDEM, join our WhatsApp group. Click Here. To subscribe to us on YouTube, Click Here.