A Nobel for Economic Disaster

This year’s Economics Nobel Prize is a cruel joke. It has been presented to three economists, one of whom is Ben Bernanke, former Chairman of the Federal Reserve.

The citation reads: “Modern banking research clarifies why we have banks, how to make them less vulnerable in crises and how bank collapses exacerbate financial crises. The foundations of this research were laid by Ben Bernanke, Douglas Diamond, and Philip Dybvig in the early 1980s. Their analyses have been of great practical importance in regulating financial markets and dealing with financial crises.”

2022 Economic Sciences Nobel Prize laureates Ben Bernanke, Douglas Diamond and Philip Dybvig

2022 Economic Sciences Nobel Prize laureates Ben Bernanke, Douglas Diamond and Philip Dybvig

Seriously? Ben Bernanke was in charge of the U.S. economy from 2005 onwards, and his policies were responsible for the great recession of 2007-08. As the Chairman of the Federal Reserve, it was his job to stem the tide of toxic housing mortgages that were spreading rampantly in the United States. He failed at his primary job and caused the crisis. He was asleep at the wheel. His irresponsibility caused the banks to fail.

This man’s policies crashed the world economy. And then he gave a free pass to the criminals who caused the crisis because they were “too big to fail.” And he gets an award for “how to make banks less vulnerable in crises” and “why avoiding bank collapses is vital?” Ask those families that lost everything how they feel about this.

What of his policies after the crash, for which the folks in Stockholm are rewarding him? Bernanke was responsible for the introduction of the irresponsible practice of printing money, also known as Quantitative Easing, which has now led to soaring inflation all over the world. The global economy, and banks everywhere, are expected to crash like never before because of this inflation, coupled with the effects of the Ukraine war.

The U.S. could get away with printing money because it has reserve currency. But thanks to its reckless policy of denying access to Russia to the dollar-based system, countries around the world have lost faith in the U.S. dollar, and are moving to de-link their economies from the dollar. China has greatly reduced its holdings of U.S. Treasury Bonds. Russia had been doing this for the past eight years, a key reason why Western sanctions have not hurt it as much as the West hoped they would.

Other countries have seen what is happening. If the U.S. could try to kill Russia’s economy, one day it might try to do the same to them. In economic terms, the U.S. used the nuclear option against Russia, as it were. So, countries are moving quietly away from the dollar and back, after 50 years, to gold-backed currencies.

Many of the economic crises that have ravaged the world are due to the world leaving the gold standard. After the Bretton Woods Conference in 1944, which led to the dollar becoming the world’s reserve currency, it was decided that the value of the dollar would be pegged to the price of gold. This was a rational system.

But in 1971, U.S. President Richard Nixon took the decision to de-link the dollar from the price of gold. But the dollar still remained the reserve currency of the world. The net effect was that the U.S. could keep printing money whenever it needed it to finance its wars – in Vietnam, Iraq, Libya, Afghanistan, and so on. The U.S. financed these wars by selling its bonds to foreign countries and loading them with dollar securities because it could print as many dollars as were needed to finance those bonds.

The New York Times – August 16, 1971

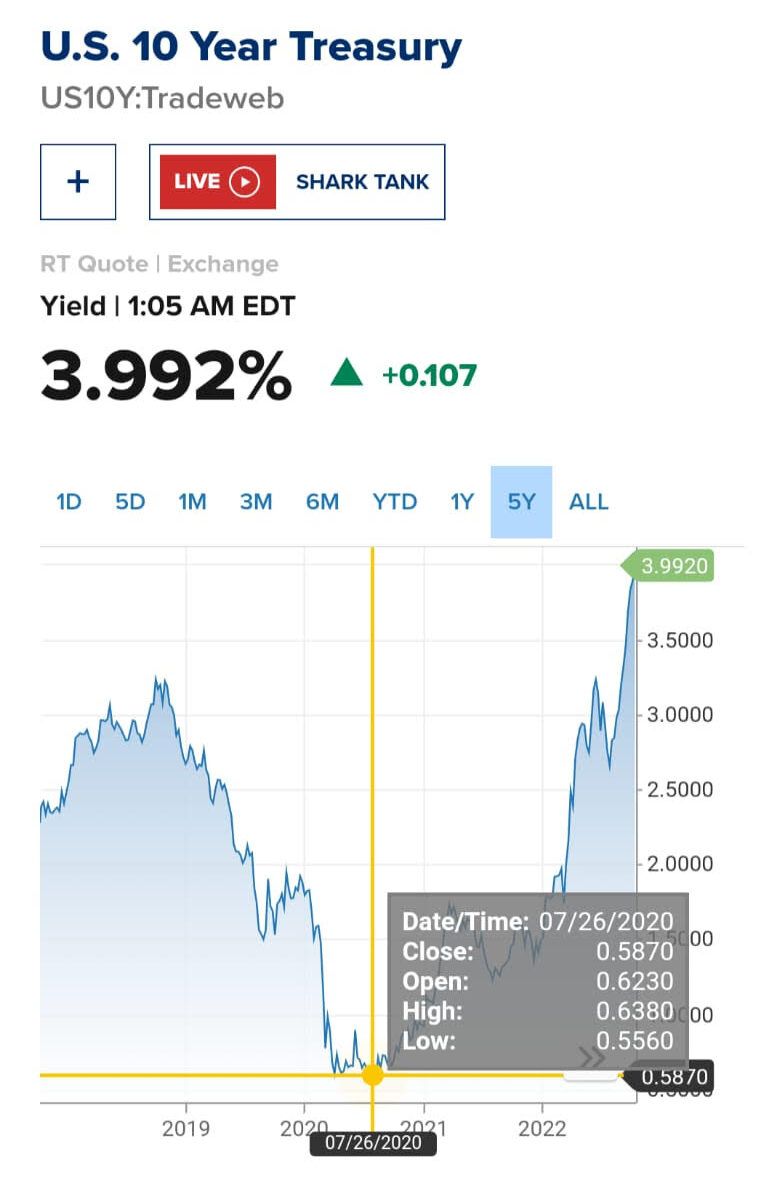

However, in the last few years, countries have been dumping the dollar. This becomes obvious when you look at the interest rates offered by U.S. treasury bonds. When the demand for your bonds goes down, you have to offer higher returns on your bonds so that people will buy them. How much demand for US bonds has gone down can be seen from the fact that, from a low of 0.6% on July 26, 2020, the interest rate on US bonds has jumped to nearly 4% today.

US10Y: U.S. 10 Year Treasury – Stock Price

US10Y: U.S. 10 Year Treasury – Stock Price

Worthless Dollar

Essentially, the US dollar is increasingly becoming worthless, and nobody wants to hold it any longer. The two countries that have been aggressively dumping the dollar are Russia and China. And the reason their action is U.S. sanctions. Under Trump, the U.S. engaged in a trade war with China, and that spooked the Chinese. Since 2014, the U.S. has been imposing sanctions on Russia. All these sanctions have led to the world viewing the U.S. as an unreliable partner who is capable of capriciously trying to destroy the economies of other countries, a perception that was only strengthened by its all-out economic war against Russia after its invasion of Ukraine.

And so, the US is going to be left holding a huge pile of paper dollars that nobody wants. This is going to end its superpower status.

All this is a consequence of the groundbreaking and unprecedented (in U.S. history) decision by Ben Bernanke to start printing money.

And for this “achievement” of his – the destruction of the American economy (admittedly, not complete yet), the Nobel Committee has decided to award the Prize to Bernanke.

If anyone should have gotten the Nobel Prize in economics for the housing crisis, it is Raghuram Rajan, because in 2005, he flagged the issue of the crazy housing bonds in a conference to Ben Bernanke, and was ridiculed at the time by Bernanke.

Actually, I agree with the decision to award a Nobel to Bernanke.

Only, it was the wrong prize.

He should have been awarded the Peace Prize.