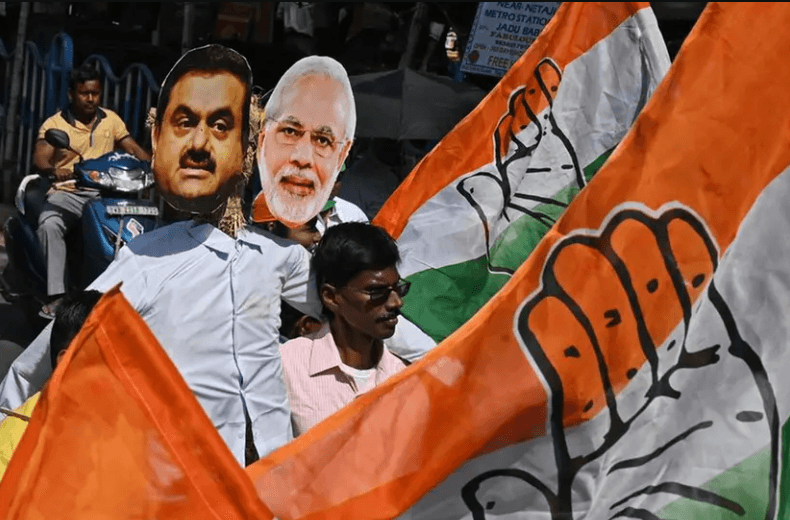

A Friend Indeed: Adani & Modi

The AIDEM’s Cover Story on the ‘Big Crash’ of the Adani group of companies and its larger economic and political fallout continues through this article. This is a timeline highlighting the growth of the Adani empire before and after 2014, the year in which the Narendra Modi regime began. Compiled by Deepa V.M.

Until a couple of weeks ago, Gautam Adani was the world’s second richest person behind Elon Musk as listed by the Bloomberg Billionaires Index. In the blink of an eye, his business empire started reeling under allegations of stock manipulation raised by a short trader, Hindenburg, on January 24, 2023. Before the fiasco created by the Hindenburg report, Adani’s net worth was US $146.8 billion (in September 2022); in the past few weeks the Adani Group lost US $100 billion.

Until a couple of weeks ago, Gautam Adani was the world’s second richest person behind Elon Musk as listed by the Bloomberg Billionaires Index. In the blink of an eye, his business empire started reeling under allegations of stock manipulation raised by a short trader, Hindenburg, on January 24, 2023. Before the fiasco created by the Hindenburg report, Adani’s net worth was US $146.8 billion (in September 2022); in the past few weeks the Adani Group lost US $100 billion.

Gautam Adani’s growth as an industrialist runs almost parallel to the meteoric political rise of Prime Minister Narendra Modi. If perused carefully, the timelines of their journeys of success can be seen as overlapping with each other so much that it could not be explained away as mere coincidence.

Adani’s Rise Before 2014

Just an aspiring teenager, Gautam Adani began his career in 1978 as a diamond sorter in Mumbai for Mahendra Brothers. After helping his brother Mahasukhbhai Adani for a few years in his plastic manufacturing business in Mumbai, Gautam Adani started his commodity trading business, Adani Exports, in 1988. Soon he expanded his venture to include exports and imports. His firm’s turnover at that time was around ₹2 crores.

By 1994, Adani Enterprises, another company of his, was listed in the Bombay Stock Exchange. Meanwhile, Adani’s firm signed an MOU with the Gujarat government to export salt from Mundra as a joint venture with Cargill, the Minnesota-based food company. When Cargill withdrew from the contract, Adani stayed on. By that time, the company’s turnover touched ₹150 crores. This is also the time when Adani moved into infrastructure sector.

Here is a timeline of his ventures until 2014:

1998: Adani owns his first ship docks in Mundra port. The first BJP government led by A.B. Vajpayee assumed office at the centre.

1999: Expands to coal trading. The company turnover rises to ₹2853 crores.

2000: Adani Enterprises becomes the largest private sector trading house in entire India and the turnover rises to ₹3300 crores. The Mundra port owned by Adani becomes India’s largest private port.

2001: Takes over urban natural gas distribution for entire India and, in a few years, becomes the country’s largest urban natural gas distributor.

2002: Year of the Gujarat pogrom. In a Confederation of Indian Industry (CII) event, many top businessmen in the country criticised Narendra Modi for the anti-Muslim violence. But Adani stood firm by his side. Later, bypassing the CII, Adani helped Modi organise the ‘Vibrant Gujarat’ international business summit, which helped Modi to re-launch himself as an icon of development before India and the world.

2006: Adani becomes India’s largest coal importer.

2007: The Gujarat government under Narendra Modi sold Adani 140 square miles of land in Mundra for a nominal price ranging from Rs.1 to Rs. 32 a square metre. Parallel to this, the Modi government declared the land surrounding this area a Special Economic Zone, thereby cutting down on taxes to facilitate the company’s growth.

2008: Makes the first overseas purchase- the Bunyu coal mine of Indonesia.

2009: Enters the power generation sector. His group acquires the Galilee mine and the Abbot Point Port in Australia.

2012: The Adani Group becomes one of India’s largest power producers. By then Mundra has grown as India’s largest port.

Adani’s Rise after 2014

Narendra Modi’s narrative of India’s growth has heavily relied on the infrastructure projects undertaken by Adani.

May 4, 2014: Narendra Modi, during his campaign for the general election, flew in a corporate jet owned by Gautam Adani; the aircraft had the name ‘Adani’ written on it in bold letters. Modi also flew to New Delhi in the same jet after BJP won the Lok Sabha elections and he was about to be sworn in as the Prime Minister of India. Narendra Modi becomes India’s Prime Minister. The Adani Group’s turnover is estimated at ₹75,659 crores.

November 19, 2014: State Bank of India (SBI) decides to give away US $1 billion as loan to the Adani Group for its Carmichael mine project in Australia. This was one of the biggest loans to be given by any Indian public sector bank for a foreign-based project. As a political controversy erupted around this, SBI did not execute this loan. However, after the dust settled around, SBI has so far given a total amount of ₹21000 crores to Adani for different projects.

2015: In his first visit to Canada and France as Prime Minister, Narendra Modi was accompanied by Gautam Adani. In the same year, the Coal Secretary, Anil Swarup, discloses that he was pressured by Narendra Modi’s secretary to give coal away to certain “privileged businessmen”. After transferring Swarup to another department, the Coal Ministry started selling coal mined by Coal India, a public sector company, to private buyers at discounted prices. Adani was the largest buyer, and he purchased 10 million tonnes, which was one-third of the total stocks. This was how Adani set off to become India’s largest private thermal power producer.

2015: The UPA government’s Environment Ministry had asked the Adani Group in 2013 to pay a penalty of ₹200 crores for violating laws and degrading the environment while implementing its waterfront development project in Mundra. In 2015, the Modi government stalled the payment under the pretext of a new environment study and eventually waived it completely in 2017.

2015: Narendra Modi visits Bangladesh. Adani Power and Reliance Power Ltd. sign separate MOUs with the Bangladesh Power Development Board (BPDB) for implementing power projects in Bangladesh. Later, in August 2015, Adani signed another MOU with the BPDB for generating thermal power in India and supplying it to Bangladesh. Soon the Godda thermal power plant is set up by Adani in Jharkhand, forcibly taking the land of the local communities with the support of the police and the bureaucracy under the BJP government in the State. The Union government under Narendra Modi amends the laws to allow standalone power projects such as Adani’s Godda power plant to function inside a Special Economic Zone. The Washington Post reported that in the contract between the government of Jharkhand and the Adani Group, the government would lose around US $240 million a year and the latter would gain more than US $1.1 billion.

2017: When a coal shortage and the ensuing power shortage hit India, the government decided to import coal at ten times the price of domestic coal and the contract was awarded to the Adani Group, the highest bidder.

2019: The Adani group, which had no prior experience in running airports, was permitted to operate six airports – Ahmedabad, Lucknow, Thiruvananthapuram, Mangalore, Jaipur and Guwahati despite the reservations expressed the by the Department of External Affairs and Niti Ayog officials.

2021:The Adani group takes over the operations of the Mumbai International Airport from GVK Group after acquiring 75% shares in the project.

2021: Sri Lanka’s Parliament documents reveal that the government of India favoured the Adani Group when a company from India had to be chosed to develop the Eastern Container Terminal of the Colombo Port. Many bureaucrats and trade union leaders of Sri Lanka spoke to the Sri Lankan media alleging that Narendra Modi pressured the Sri Lankan President to give the project to Adani. The Adani Group’s total turnover reaches ₹1,78,946 crores. Adani tripled his wealth in this Covid-19 year when almost all businesses were down.

August 2022: The Adani Data Networks Limited wins the bid for 5G spectrum band worth ₹212 crores. The company intends to use this spectrum band to create a private network for its data centres and other business operations. About half of the spectrum is owned by Mukesh Ambani’s Reliance Jio.

September 2022: The Adani Group acquires two major cement companies, Ambuja Cements and ACC. Adani’s wealth doubles.

December 2022: The BJP-supported Maharashtra government awards the Dharavi redevelopment project to Adani. Dharavi is spread over 240 hectares of land in the middle of Mumbai city. The project will involve rehabilitating 60000 families and developing the area into modern housing and commercial building complexes. Earlier a Dubai-based company had outbid Adani for the same project but then the government cancelled the bidding process resulting in a court case which is not settled yet.

January 24, 2023: The Hindenburg report alleges that the government of India was hand in glove with the Adani Group. The report says, “The Adani Group Has Repeatedly Faced Allegations Of Corruption, Money Laundering And Theft Of Taxpayer Funds, Totaling An Estimated U.S. $17 Billion. Investigations Have Either Been Stalled Or Stonewalled By Various Arms Of The Indian Government.”

Under the two terms of Narendra Modi’s prime ministership, Adani Group’s growth has been estimated at 4500%, an unrealistic and unprecedented trajectory even for a highly successful business in the history of corporate growth.

References

‘Anything for a friend: Why PM Modi owes an explanation for Adani’s miraculous rise,’ Ravi Nair, National Herald, February 12, 2023.

‘The Rise and Rise of Gautam Adani,’ The Economic Times, September 05, 2013.

India’s 100 richest 2022, Forbes India.

‘Adani Group: How the World’s 3rd richest Man is Pulling the Largest Con in Corporate History,’ Hindenburg Research, January 24, 2023.

‘How Political Will Often Favours a Coal Billionnaire and his Dirty Fossil Fuel,’ Gerry Shih, Niha Masih and Anant Gupta, The Washington Post, December 9, 2022.

‘UPA vs NDA: How Adani Group transformed under the two governments,’ Rahul Oberoi, Business Today, February 11, 2023.

‘Modi’s Rockfeller’: Gautam Adani and the Concentration of Power in India, Stephanie Findlay and Hudson Lockett, Financial Times, November 13, 2020.

To read and view more from the Adani Crash Cover Story package, Click here.